A New Alarm Bell Signals Hot Inflation is HERE

Posted February 18, 2021

Graham Summers

We’ve been outlining some pretty extraordinary items on these pages over the last few weeks.

Here’s a brief recap:

- If you add up all of the money the U.S. has ever printed… over 40% of it was printed in 2020 alone.

- In three months in 2020, the U.S. increased its deficit by more than it had during the past five recessions combined (’73, ’75, ’82, early ‘90s and the Great Financial Crisis of 2008).

- Under Jerome Powell, the Fed bought more Treasuries in SIX WEEKS than it did in 10 years under Ben Bernanke and Janet Yellen.

- Agricultural commodities prices are up nearly 40% since August.

Well, buckle up, because today we’ve got a new astonishing fact…

The Commodity Research Bureau (CRB) index is up 75% since its April low — more than double the performance of stocks over the same time period.

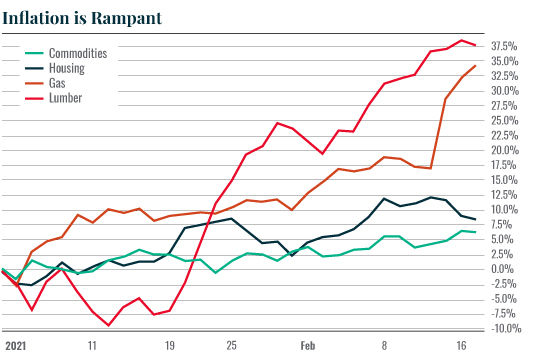

Take a look at the chart above. Does this seem normal or healthy to you: That commodities, which are essentially inflation hedges, are more than DOUBLING the performance of stocks?

The point I keep trying to hammer home — inflation has entered the financial system. And as we know from history, once it appears, nothing stops it except the Fed tightening monetary policy by aggressively raising interest rates as Paul Volcker did in the late ‘70s early ‘80s.

However, the Fed is unwilling to even acknowledge that inflation is a problem right now.

The Fed is Willfully Ignoring This

Mary Daly, President of the San Francisco Fed, said earlier this week that inflationary pressures are now “downward,” meaning inflation is disappearing. She also added it’s “not time to worry about inflation risks right now.” And that doing so would cost the economy jobs.

As if that wasn’t baffling enough, Boston Fed President Eric Rosengren commented yesterday that inflation is not likely to hit the Fed’s target until 2022. (By the way, the Fed’s target is just 2%.)

Real inflation is well north of this already. Year to date, agricultural commodities are up 6%, housing prices are up 8%, gasoline prices are up 34%, and lumber prices are up a whopping 37%.

And we have multiple Fed Presidents claiming that inflationary pressures are downward and that inflation won’t hit 2% until 2022!!

Folks, the Fed is asleep at the wheel and it’s going to allow inflation to rage out of control.

Best Regards,

Graham Summers

Editor, Money & Crisis