“Gold as a Near-Term Inflation Trade?”

Posted March 30, 2021

Graham Summers

Yesterday we assessed gold as a long-term investment.

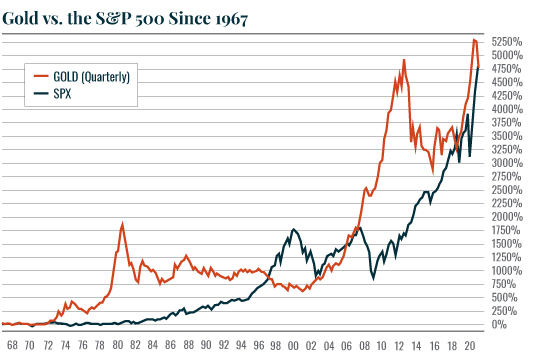

As a brief recap, gold is a TERRIFIC long-term investment as the chart below shows. It tracks the precious metal’s performance relative to stocks since 1967 — when gold was no longer pegged to currencies.

Today we’re going to assess gold as a near-term trade based on inflation.

Gold is indeed an inflationary hedge. And with inflation on the rise, gold should do very well — eventually.

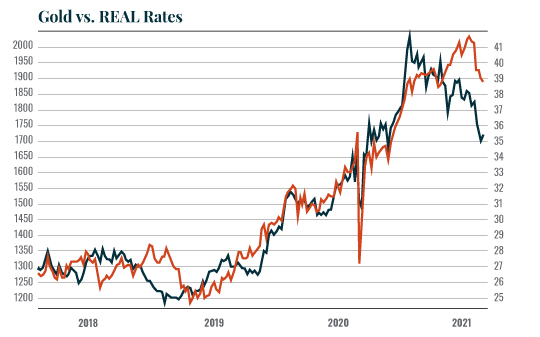

I say eventually because in the near-term, gold primarily trades based on real rates.

Real rates are the inflation-adjusted return you’d make by lending your money to the U.S. government.

To do this, you need to subtract what you’d earn from owning Treasury Inflation-Protected Securities (TIPS) from what you would earn from owning normal Treasuries. Doing this provides you with what’s referred to as “real rates” or the REAL (inflation-based) return you get from owning an asset.

(I’ve previously talked about the TIPS/Treasury ratio as an indicator of screaming inflation…)

You can see the close relationship between gold and real rates in the chart below:

Two Factors When It Comes to Gold and Inflation

With this in mind, the key for buying gold based on inflation hinges on two things:

- 1) What real rates are doing.

- 2) What the $USD is doing.

Regarding the first point, real rates are currently stabilizing after a recent correction. Until we see real rates break out of this consolidation to the upside in a BIG way, then gold will continue to experience some downward pressure.

Unfortunately, the U.S. Dollar isn’t helping the situation either…

Gold is denominated in $USD. So, when the dollar strengthens, gold typically experiences some downward pressure. And unfortunately, that is precisely what is happening right now.

As the below chart reveals, the $USD has entered something of an uptrend (blue lines) breaking through several lines of resistance (red lines).

This has ALSO put downward pressure on gold. As a result, the precious metal has been in a downtrend for the better part of the last six months.

So where does this leave us?

As traders, I would potentially open a position in gold in the $1,600s. However, I would not think about “backing up the truck” to buy the precious metal until it breaks below $1,600. I’ve drawn these two lines of support in the chart below.

These are the areas that gold becomes “attractive” for a trade. But until then, it’s “buyer beware” because both the bond and the currency markets are not working in gold’s favor.

Best Regards,

Graham Summers

Editor, Money & Crisis

P.S. Whether you’re buying it for the long haul, or as a near-term inflation play, you want to be sure to buy physical gold. We have a partner company that can help you do just that — Hard Assets Alliance. They make buying and storing your gold super-simple. You can get all your questions answered and set up an account at no charge right here.