Inflation is Coming… Here’s Why

Posted October 16, 2020

Graham Summers

Yesterday I outlined how the recent spike in food prices signals big inflation is coming soon.

As a brief recap, according to the Fed’s own research, food inflation is the single best predictor of future inflation in the U.S.

In a little-known paper published back in 2001, the Fed openly admitted that its official measures of inflation — the Consumer Price Index (CPI) and the Price Index for Personal Consumption Expenditures (PCE) — do a horrible job of predicting future inflation.

So, what does predict future inflation well?

FOOD prices.

“We see that past inflation in food prices has been a better forecaster of future inflation than has the popular core measure…Comparing the past year’s inflation in food prices to the prices of other components that comprise the PCEPI (as in Table 1), we find that the food component still ranks the best among them all…”

–The Federal Reserve Bank of St. Louis

I want you to focus on these two admissions:

- The Fed has admitted that its official inflation measures do not accurately predict future inflation.

- The Fed admitted that FOOD prices are a much better predictor of future inflation. In fact, food prices were a better predictor of inflation than the Fed’s PCE including non-durable goods, transportation services, housing, clothing, energy and more.

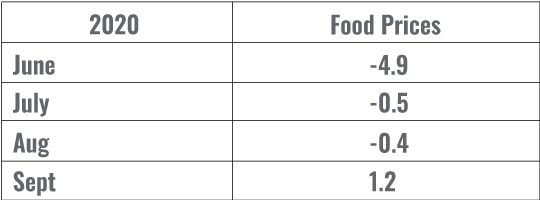

With all of this in mind, consider that the single month increase of 1.2% in food prices we saw in September is a BIG Deal.

Remember, this price spike occurred across the board (not just one area like meat or dairy). And as the following table indicates, this was a SHARP rise in inflation after several months of lower inflation.

Another Indicator of Coming Inflation

What you are seeing here is an aggressive acceleration of food inflation. If this trend continues it is all but guaranteed that we will see an inflationary storm hit in the first half of 2021.

Gold knows it too.

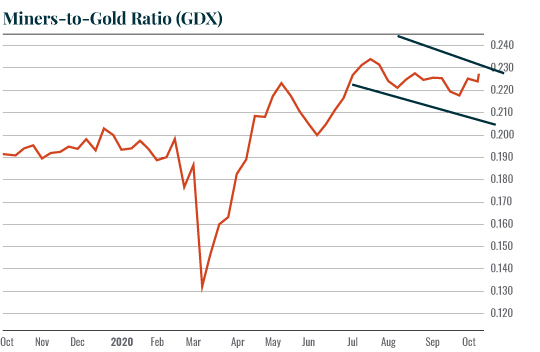

As I’ve previously noted, during inflation-driven bull markets in gold, gold miners typically outperform the precious metal. For this reason I like to track the “gold miners-to-gold” ratio (GDX: $GOLD).

When gold miners outperform gold, this ratio rises. When gold miners underperform gold this ratio falls.

As you can see in the GDX: miners-to-gold ratio is in a clear bull flag formation. This is EXTREMELY bullish and signals that we are about to see an explosive move in which gold miners drive higher, outperforming even gold.

The market is telling us higher inflation is coming. Are you prepared?

Best Regards,

Graham Summers

Editor, Money & Crisis