More Evidence Of a Coming Spike in Gold

Posted October 23, 2020

Graham Summers

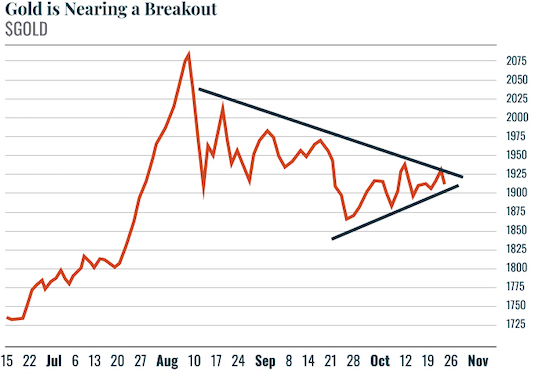

The sell-off in gold yesterday brought the precious metal to an even tighter part of the triangle formation. More and more pressure is building here and the coming move is going to be violent.

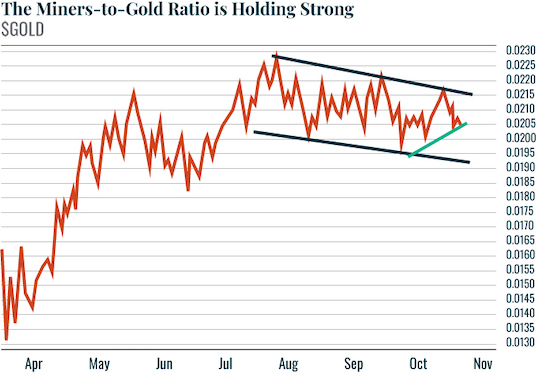

Interestingly enough, despite gold taking it on the chin yesterday, the gold miners-to-gold ratio (GDX: $GOLD) barely dipped at all. Put another way, the set up here is no less bullish. That’s exactly what we want if the next major move is going to be up.

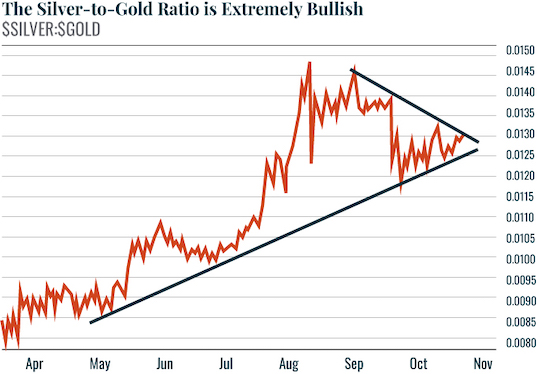

Similarly, the setup in the silver-to-gold ratio remains extremely bullish. Here again, this is what we want if the next major move is going to be up.

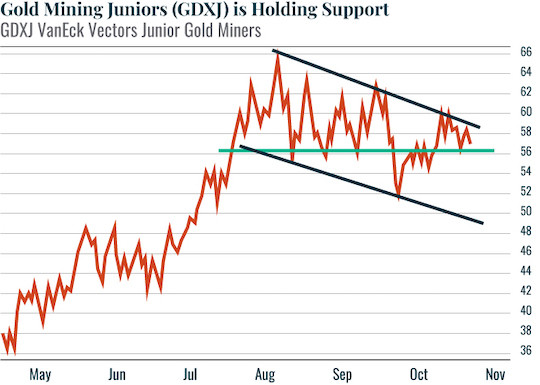

Finally, Gold Mining Juniors (GDXJ), which typically leads gold, held support yesterday. We are perhaps one or two up days away from a breakout here.

This too is extremely bullish.

Best Regards,

Graham Summers

Editor, Money & Crisis