The China Factor That’s Driving Inflation

Posted June 09, 2021

Graham Summers

Over the last two days we’ve outlined just how dangerous Treasury Secretary Janet Yellen’s views on inflation and interest rates are.

By quick way of review:

- Secretary Yellen believes that President Biden’s $4 trillion spending program would be good for the U.S. — even if it contributes to higher inflation and results in higher interest rates.

- Inflation is already roaring in the U.S. before President Biden’s $4 trillion spending program. Higher inflation would NOT be good at this point as Americans are already experiencing rising costs of living

- Higher interest rates would also be extremely problematic as the U.S. now has $28 trillion in public debt. This massive debt load requires extremely low interest rates for the U.S. to avoid a debt crisis. The last time interest rates spiked higher in 2018, the corporate debt market froze, and the stock market collapsed 20% in a matter of days.

With this in mind, we have to ask ourselves: If the Treasury is this clueless about the financial system… just how bad will inflation get?

Hint: BAD.

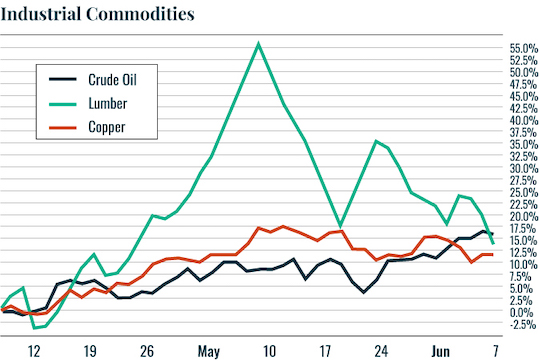

The current official rate of inflation, as measured by the Consumer Price Index, is 4.2%. This is a 13-year high. And there are no signs it is slowing. Copper, lumber and crude oil prices are all up double digits in the last 60 days.

The China Factor Behind Inflation

Moreover, there are structural issues that suggest higher inflation is here to stay. As MN Gordon recently noted on Economic Prism, for decades China kept consumer prices low in the U.S. by using a managed exchange rate that supported cheap labor costs.

That era is ending. In fact, China currently has a shortage of factory workers. As a result, Chinese manufacturers are either raising prices or simply refusing to accept new orders.

Both of those are highly inflationary.

If Chinese manufacturers start raising prices, it’s only a matter of time before we start seeing the costs of goods increase in the U.S. Sure importers and distributors might be able to stomach high costs from China for a short time, but eventually they will need to raise prices themselves or become unprofitable.

Similarly, if Chinese manufacturers refuse to accept new orders, it’s not as though U.S. demand is going away. As the U.S. economy reopens, Americans are going to want to shop, spend money, and otherwise return to normal.

Less supply with more demand means HIGHER prices.

So, forget about inflation being transitory. There are deep structural issues between the U.S. and China that have completely changed.

Small wonder then that gold has begun breaking out to the upside in every major currency: U.S. Dollars, Euros, Japanese Yen and Swiss Francs.

Now is the time to start preparing for higher inflation.

Best Regards,

Graham Summers

Editor, Money & Crisis