The Sector to Watch For Signs of a Biden Win

Posted October 20, 2020

Graham Summers

From a 20,000-foot perspective, this Presidential election is about globalism vs. nationalism.

Globalism, as represented by the Biden campaign, represents the dominant economic trend of the last 40 years. Its key features include:

- The outsourcing of Americans jobs to cheaper, international labor markets.

- The U.S. relying extensively on other nations for its energy, commodity, and other needs.

- The U.S. as one of several key nations that set global policy via international bodies (the U.N. the G-7, etc.).

By way of contrast, Nationalism, as represented by the Trump administration, represents a complete refutation of Globalism. Its key points assert:

- That the domestic production of resources deemed critical to the U.S. economy is a matter of national security.

- That outsourcing weakens the U.S. economy from a strategic perspective as it shifts its industrial and manufacturing supply chains to other nations.

- That the U.S. is THE dominant force in the world and as such can set global policy regardless of what other nations desire.

Obviously, there are a lot of key differences between these two, particularly regarding the role of the U.S. economy on the global stage. The implications for the markets are many, but the clearest one pertains to the natural resources sector.

An Energy Crisis in the Making

If Biden wins the election, I would expect the U.S. natural resources sector to collapse, particularly the energy sector. Biden has endorsed the Green New Deal which advocates ending the use of fossil fuels as an energy source.

This would cause the energy sector to implode.

With that in mind, let’s take a look at what the energy sector is telling us about Biden’s odds on November 3, 2020.

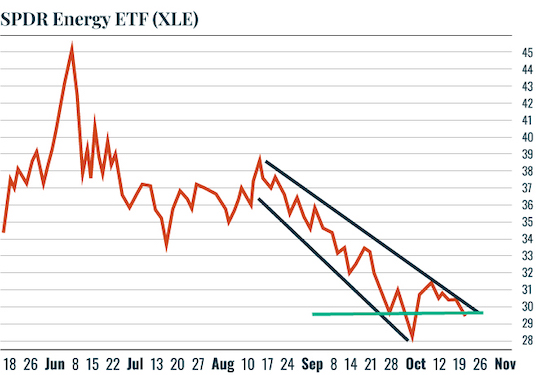

The Energy ETF (XLE) is in a clear downtrend. However, it looks as if it may have bottomed on October 1, 2020. Moreover, it has held support (green line) during this recent pullback.

All of these are bullish developments that suggest Biden’s odds of winning are lowering by the day. If XLE breaks out of that downtrend, it’s GAME OVER.

I’m watching this sector closely. The market is already telling me the odds of Trump winning re-election are 60/40. But if XLE breaks out to the upside, I’d increase it to 80/20.

Best Regards,

Graham Summers

Editor, Money & Crisis