The Simple Economics of What’s Headed Our Way

Posted January 15, 2021

Graham Summers

We’ve covered a lot of ground in the last few days. So before proceeding, let’s do a brief recap.

- The US owes over $27 trillion in debt today.

- A debt mountain of this size requires bond yields to stay low in order for the U.S. to remain solvent.

- Treasury yields, however, have begun rising as inflation has appeared in the financial system (yields trade based on inflation as well as other items).

- If bond yields rise too much, it will trigger a bear market in bonds, which would lead to crashes in stocks, real estate, municipal bonds and corporate bonds all at the same time (the “Everything Bubble” would burst).

- The Fed will be forced to choose between defending bonds or the U.S. dollar. I believe it will choose to defend bonds and let the U.S. dollar collapse.

- This will result in a 15%-20% drop in the U.S. dollar, triggering an EXPLOSIVE move in inflation hedges.

Put simply, when push comes to shove, and the Fed has to choose between defending bonds or defending the U.S. dollar, the Fed will choose to defend bonds.

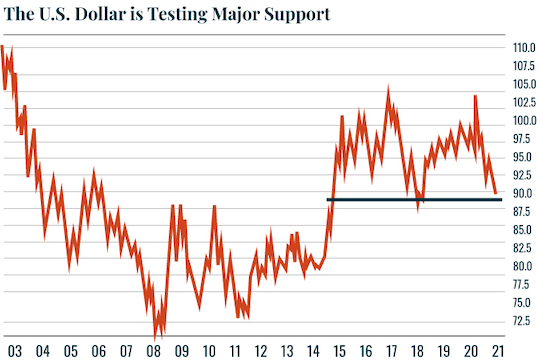

And this will result in the $USD collapsing. I’m not talking about some kind of “Death of the U.S. Dollar” crash, but an aggressive drop to the tune of 15% or more. The market is already sensing this with the $USD falling to critical support. A break below this line would likely see the U.S. Dollar Index ($USD) dropping to the 70s.

So how do we invest in this climate?

Economics 101

We look to inflation hedges… things that cannot be printed.

Remember, the basic rule economics is that the more of a given asset there is, the less each individual unit is worth.

Think of sand. According to NPR, there are roughly five quadrillion grains of sand in the world. Because it’s so common, you can buy 50lbs of sand for less than $10. And the reality is that what you’re really paying for is the cost of labor and shipping that the sand company incurs to bag the stuff and ship it to you. The reality is sand is free provided you can get to a beach.

By way of contrast, there are only 2.5 billion ounces of gold above ground today. That sounds like a HUGE amount of gold, but compared to sand? It’s infinitesimal. Not only is gold much rarer, but it’s much harder to get ahold of (you have to mine for it). As a result, a pound of gold is worth over $21,000.

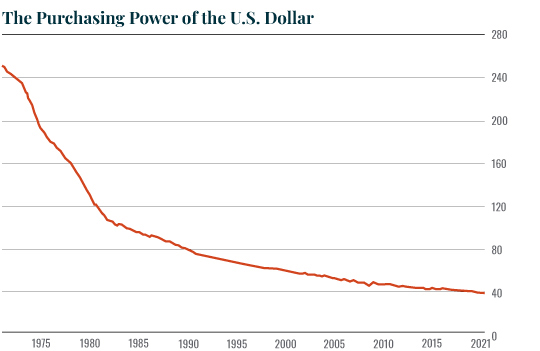

The same thing happens with money. The more of it you print, the less each unit is worth. That’s why the purchasing power of the U.S. dollar has been falling like a stone ever since the U.S. broke away from the Gold Standard in 1971. And why it will fall even MORE aggressively when the Fed is forced to engage in unlimited QE (unlimited money printing) to defend Treasuries in the coming months.

Some of the assets I’m looking at to profit from this include:

- Gold, silver and other precious metals (palladium, platinum, rhodium and the like).

- Rare earths elements.

- Lithium, cobalt, and other commodities that are linked to green energy.

- Lumber and other commodities linked to housing which will boom as rates are forced even lower.

- Emerging markets.

I’ll outline a specific investment I like in Monday’s article. Until then…

Best Regards,

Graham Summers

Editor, Money & Crisis