Think Economic News Drives the Stock Market?

Posted March 11, 2021

Graham Summers

Stocks continue to bounce this morning.

And why shouldn’t they? President Biden is about to sign a $1.9 trillion stimulus bill… and the European Central Bank (ECB) just announced it will be expanding its QE program. (In the U.S., it’s part of the massive money printing plan I’ve written about before.)

At the end of the day, stimulus and money printing have been the central driving forces of the stock market. And as statistical analysis has shown, it is LIQUIDITY, not the real economy, which drives markets.

Yes, I am claiming that the economy has little to no impact on stocks. And if you don’t believe me, consider that the mutual fund giant Vanguard performed a study analyzing the correlation between stock market returns and various fundamental factors (dividend yield, stock market valuations, etc.) from 1926 to 2011.

They found that the correlation between stock market returns and the direction or trend of GDP growth was 0.05, or about 5%. Put another way, the trend of the economy only explained roughly 1/20 of the stock market’s returns.

To put this into perspective, it’s lower than the correlation between rain and stock market returns. Yes, rain, as in whether or not it’s raining outside on a given day.

Seeing is Believing

If you still find this hard to believe, let’s take a real-world example.

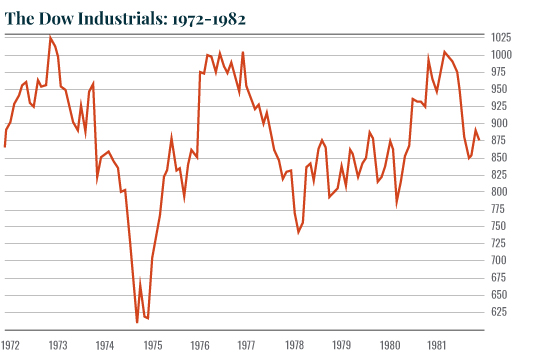

Between 1972 and 1982, the U.S. economy nearly tripled in size from $1.2 trillion to $3.2 trillion. And yet, throughout that entire period the stock market traded sideways for ZERO GAINS!

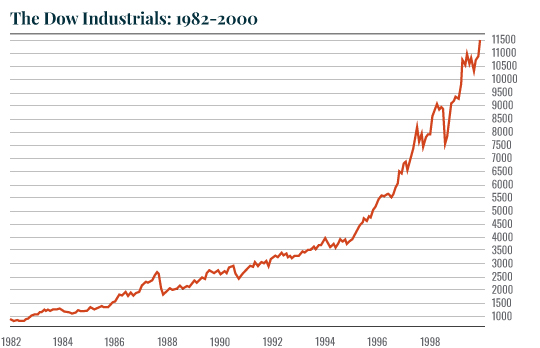

In contrast, from 1982 to 2000, the U.S. economy again nearly tripled in size from $3.2 trillion to $10 trillion. But during this particular time, the stock market exploded higher, rising nearly 1,500%!

So, we have two time periods in which the economy nearly tripled in size. During one of them, stocks went nowhere. During the other, the market rose nearly 1,500%.

Again, stocks have little if any correlation to the economy. Anyone who claims otherwise doesn’t know what he or she is talking about.

So what do stocks care about?

Liquidity. And I’ll detail how and why in tomorrow’s piece.

Best Regards,

Graham Summers

Editor, Money & Crisis