Warning: The Fed is Now a Political Entity.

Posted September 03, 2021

Graham Summers

Despite all the buildup, Fed Chair Jerome Powell’s Jackson Hole speech was a non-entity.

Powell managed to talk for quite a bit without saying anything of note. His speech was effectively a rehashing of the same points he’s made for the last six months:

- The recovery is underway but we’re not out of the woods yet.

- Inflation is transitory and nothing to worry about.

- We seek maximum employment.

- Inflation should return to 2% in the intermediate term.

- Covid-19 or one of its variants could prove a problem for the economy.

Again, the words of the speech were practically useless in terms of presenting anything new. Powell didn’t even provide any details on when the Fed might taper its $120 billion QE program. He simply stated that the Fed plans to do it if the economy continues to strengthen… which again, is what he has been saying for months now.

Indeed, it was the LACK of substance in Powell’s speech that gave us the most information. By refusing to provide details, or any useful information, Powell revealed that he is playing a political, not an economic game.

Let’s be clear here.

The Fed’s Dual Mandate as set out in the 1977 Amendment to the Federal Reserve Act is to provide price stability and maximum sustainable employment.

We’ve already assessed over the last few weeks that inflation is rising. So the Fed is failing to maintain price stability by refusing to tighten monetary policy.

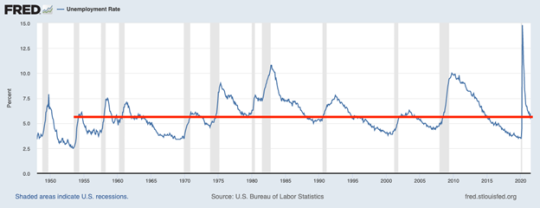

Moreover, the unemployment rate is back to 5%, where it has been throughout much of history during major growth portions of the cycle. I’ve illustrated this level of unemployment running back 70 years. As you can see, there is no reason from an employment perspective, for the Fed to not tighten monetary conditions here either.

On top of this, stocks are at all-time highs. Housing prices just rose 18% year over year (a record). Even the ridiculous Consumer Price Index (CPI) which is designed to understate inflation is clocking in at over 5%.

In simple terms, there are ZERO economic reasons for the Fed to NOT taper QE and hike rates right now. Heck, every night over $1 trillion in excess cash is parked at the Fed via reverse repos because financial institutions and hedge funds don’t need it.

So why on earth would Powell NOT use Jackson Hole to outline the Fed’s plan to tighten monetary policy!?!?

The answer is politics.

Powell’s current term as Fed chair ends this year. As I noted a few weeks ago, the Biden administration leaked (via Bloomberg) that it intended to reappoint Powell as Fed Chair in July.

It is now clear that Powell has cut a deal with the Biden administration to win reappointment.

That deal?

Keep the easy money flowing.

Again, there are no economic reasons for the Fed to continue its current monetary path. The fact that Jerome Powell won’t even commit to presenting a clear timeline for when the Fed will taper is truly negligent.

This presents us with a truly disturbing issue. The Fed is supposed to be independent. If the Fed is NOT independent, but is in fact a political entity, then why would the Fed tighten monetary conditions after Jerome Powell is reappointed? Why not wait until after the 2022 mid-term elections or some other political date?

Bottom line: the Fed is very likely now a political entity and inflation will rage.

Best Regards,

Graham Summers

Editor, Money & Crisis