What on Earth is the Fed Thinking!?

Posted March 04, 2021

Chuck Dolce

The Fed continues to be asleep at the wheel.

At a time when inflation is already well above 2%, when copper has risen 40% in the last six months, while gasoline is up 53% over the same time period, and agricultural commodities as a whole are up 31%... the Fed continues to claim inflation is non-existent.

Yesterday the President of Federal Reserve Bank of Chicago, Charles Evans, stated that it would be “extraordinary” if inflation even reached 3% in the coming months.

Yes, these people are that delusional.

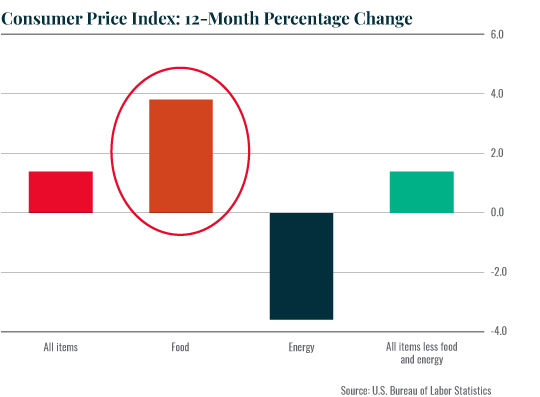

The Fed’s OWN research shows that food inflation is the single best predictor of future inflation… and food inflation is clocking in at 3.8%.

Indeed, if it weren’t for the fact that energy prices are still down from where they were 12 months ago (pre-pandemic), even the government’s own inflation measure would show inflation is RAGING right now.

If this isn’t enough… consider that the Fed’s Beige Book, which serves as its primary source for what the real economy is doing, contains the following statement, “businesses in most sectors expect fairly widespread increases in the prices they pay in the months ahead…”

So, you’ve got real businesses in MOST sectors telling the Fed to its face: higher prices are coming. And by the way, “higher prices” means inflation.

And then of course there’s the Institute for Supply Management (ISM) which just reported that “prices paid,” which measures what suppliers are paying for materials, has spiked to its highest level since 2008.

Put another way, even if you were a delusional economist at the Fed, who only tracks the “official” data points, all of which are designed explicitly to understate inflation, you’d know that inflation was already running hot.

And yet, Fed officials believe it would be “extraordinary” for inflation to even hit 3%.

Let’s Not Forget the Other Thing Signaling Inflation

Oh, and by the way, bond yields, which are what triggered the recent bloodbath in tech stocks, are spiking higher again.

As I’ve been warning for weeks, inflation is already in the financial system. The only thing that could stop it would be if the Fed began to tighten monetary policy aggressively.

And the Fed doesn’t even believe inflation will be a problem in the future.

This is total insanity. And it is going to end horribly.

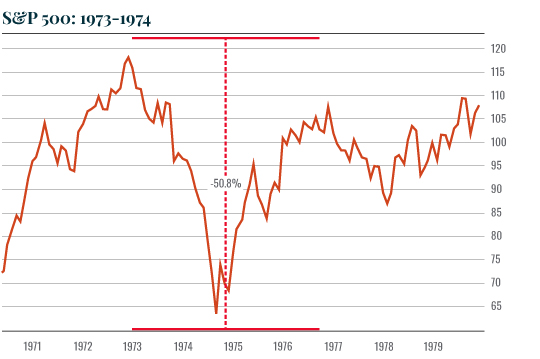

During the last bout of hot inflation in the 1970s, stocks initially bubbled up before CRASHING nearly 50% in the span of two years, wiping out ALL of their initial gains and then some.

As I kept warning for weeks, the coming inflation is going to ANNIHILATE most investors' portfolios.

But those who are properly prepared, however, will make literal fortunes.

Best Regards,

Graham Summers

Editor, Money & Crisis