What’s Driving this Shift in the Stock Market?

Posted January 22, 2021

Yesterday we outlined how both financial and energy stocks were outperforming the tech sector.

By quick way of review:

- Tech was THE top performing sector for most of 2020, beating most other sectors by a wide margin.

- However, starting in August 2020, capital began to rotate out of tech and into financials and energy.

- Since that time, financials and energy have been outperforming tech by a wide margin.

So, What’s Going on Here?

What’s going on here is the market is “smelling” inflation.

Financials trade based on interest rates. That’s because banks make money on the spread between the interest rates they pay on deposits and the rates they charge on loans. So if rates are rising, meaning banks can charge more for lending money, their profits rise too.

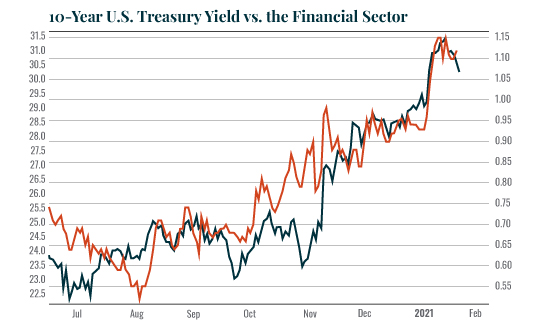

And as I’ve noted earlier this week, rates are currently rising as bonds adjust to higher inflation. This has greatly benefited financials as the below chart reveals.

The chart compares the performance of the 10-Year U.S. Treasury yield (red line) to the performance of the Financial Sector ETF (blue line). As you can see, as bond yields rise to adjust for higher inflation, financial stocks have rallied strongly.

A Similar Pattern is Playing Out with Energy Stocks

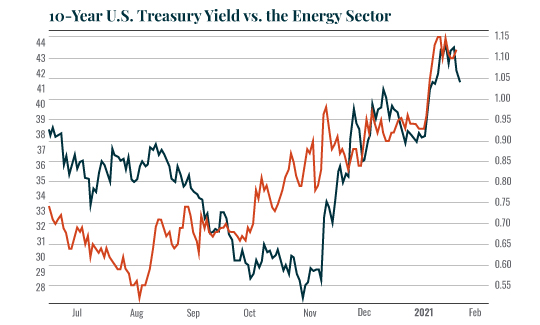

Oil and other energy commodities are inflation hedges. As such, they tend to rise with inflation. So it’s not surprising that, as inflation has risen in the financial system, so too have energy stocks.

The chart below compares the performance of the 10-Year U.S. Treasury yield (red line) to the performance of the Energy Sector ETF (blue line).

The relationship between these two is not as strong as the one between the yield on the 10-Year Treasury and financial stocks, but it’s still a solid correlation.

Put simply, the reason financial and energy stocks are doing so well is because inflation is increasing in the financial system.

This provides even more evidence that inflation is going to be the BIG theme for the markets in the coming months.

Best Regards,

Graham Summers

Editor, Money & Crisis